UAE profits from Russian gold sanctions 2023

Since Western sanctions over Ukraine disrupted Russia’s usual export channels, Russian customs data reveal that the UAE is a major gold trade hub.

The Gulf state bought 75.7 tons of Russian gold worth $4.3 billion in 2022, up from 1.3 tons in 2021.

China and Turkey imported 20 tons apiece between Feb. 24, 2022 and March 3, 2023. According to customs data, the three nations exported 99.8% of Russian gold with the UAE.

After the Ukraine crisis began, several global banks, transportation companies, and precious metal refiners stopped processing Russian gold, which was usually transferred to London for trade and storage.

By August, Britain, the EU, Switzerland, the US, Canada, and Japan had prohibited Russian bullion imports.

However, export records reveal that Russian gold manufacturers rapidly found new customers in nations like the UAE, Turkey, and China that had not sanctioned Moscow.

A gold sourcing specialist at the Organization for Economic Cooperation and Development, Louis Marechal, warned that Russian gold may be melted down and recast to reenter U.S. and European markets.

“If Russian gold comes in, is recast by a local refiner, sourced by a local bank or trader, and then sold on into the market, there is a risk,” he added. End buyers must perform due diligence to comply with sanctions regimes.

The UAE Gold Bullion Committee claimed the state has clear and effective mechanisms against illegal commodities, money laundering, and sanctioned businesses.

The UAE would trade freely and honestly with its foreign partners in accordance with UN principles, it stated.

Gold hub

Washington has warned nations like the UAE and Turkey that they might lose access to G7 markets if they conduct business with U.S.-sanctioned organizations to further isolate Russia.

Russia’s gold export restriction starts G7 summit.

Reuters data suggests those countries have not violated U.S. sanctions.

Sanctions are enforced by the U.S. Treasury’s OFAC.

According to Metals Focus, Russia produced 325 tons of gold in 2022, while customs data provided to Reuters by a commercial vendor shows 116.3 tons of exports between Feb. 24 and March 3.

Russia’s unrecorded gold presumably stayed in the nation or was exported. Reuters couldn’t identify what percentage of Russia’s gold shipments the data covered.

Hong Kong received most Russian gold exports to China. China’s Foreign Ministry stated cooperation with Russia “shall be free from disruption or coercion from any third party”.

The Turkish finance ministry declined comment. Russian authorities did not comment on gold exports.

London is not dependent on Russian exports, so the move is hardly a significant blow. British trade statistics suggests that Russia supplied 29% of London’s gold imports in 2021 but only 2% in 2018.

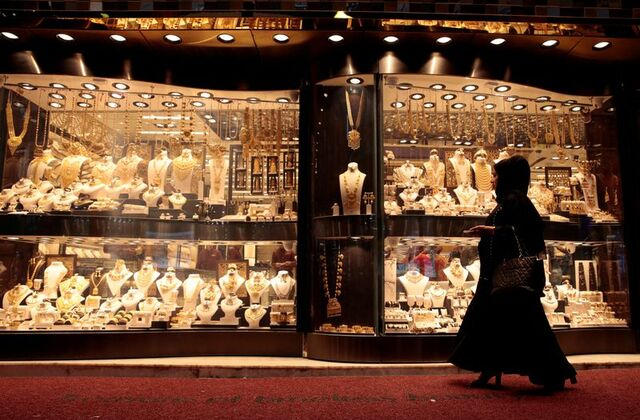

The UAE has a long-established gold industry. Trade figures suggest it imported around 750 tons of pure gold a year on average between 2016 and 2021. The Russian records would only account for about 10% of its imports.

Bullion and jewelry are prominent UAE exports.

Price cuts

The boss of one company that exported big amounts of Russian gold to the UAE told Reuters that Russian firms had been selling bullion there at a discount of approximately 1% to global benchmark prices, encouraging trade.

The manager, who requested anonymity, claimed most of the gold his business sold to the UAE was melted down and recast in refineries.

Russian gold miners were contacted by Reuters. Nordgold and Norilsk Nickel declined comment. Polyus and Polymetal ignored.

Click here for a FACTBOX about some of the biggest Russian gold shippers since the Ukraine crisis.

Shippers and dealers, not refiners, jewelers, or investors, are often listed in customs records.

Temis Luxury Middle East, a Dubai subsidiary of French logistics business Temis Luxury, was the largest handler of Russian gold exported to the UAE from April 2022 to March 3, shipping 15.6 tons worth $863 million.

“We fully comply with the laws and regulations of the United Arab Emirates for freight forwarder business,” stated Temis Luxury Group compliance head Broca Houy.

Temis exclusively accepted transport orders from operators not subject to U.S. sanctions and did not acquire Russian gold.

France’s finance minister said it would not discuss the shipments but was committed to penalties.

According to Reed Smith sanctions lawyer Tan Albayrak, European corporations whose subsidiaries sent Russian gold to the UAE, Turkey, or Hong Kong did not break the law.

Transguard, part of Emirates Group, the airline-to-hotels enterprise owned by the Gulf state’s wealth fund, was the UAE’s second-largest handler of Russian bullion, handling 14.6 tons worth $820 million.

Emirates stated it had never acquired Russian gold, functioned legally, and stopped transferring it.

“Due to recent regulatory developments, Transguard is no longer providing logistics services for gold shipments to or from Russia,” it added.

Chinese logistics business Vpower Finance Security Hong Kong Ltd handled most Russian gold shipments in Hong Kong. Records reveal it imported 20.5 tons of gold worth $1.2 billion between May 2022 and March 3.