ITC Shares Decrease As Hotel Business Spinoff Plan Is ‘Back On The Table’ 2023

On Tuesday, shares of ITC Ltd. experienced their worst one-day drop in more than a week after the firm said that it will relaunch its proposal to split apart the hotels industry now that the sector had recovered from the pandemic’s lows.

ITC Chairman Sanjiv Puri stated in an interview with Hindu BusinessLine that the conglomerate was exploring for a “alternative business structure” for its hotel division.

According to Puri, the key reason why the demerger plan is “back on the table” is because the company’s hotel industry has recovered since the epidemic.

ITC Shares Recover Some of Their Losses After Experiencing Their Largest Drop in Almost a Week

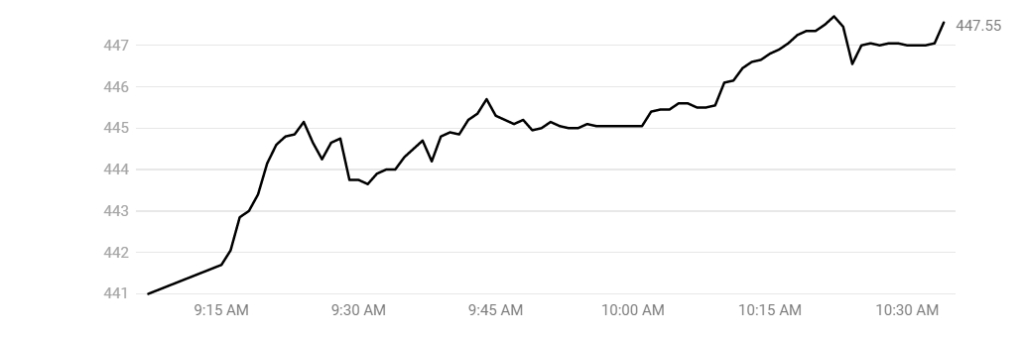

ITC Ltd. shares dropped by 1.80% during the trading day before recovering some of their losses and traded at a low of 0.56% to Rs 446.6 per share as of 10:15 in the morning. In contrast, the Nifty advanced by 0.31 percent within the same time period. Since May 19, the share price has fallen by the greatest in almost a week’s time.

The overall volume of trades reached 1.6 times the 30-day moving average. Given that the relative strength index was at 72, it appeared as though the stock may have been overbought.

According to data provided by Bloomberg, out of the 38 analysts that follow the firm, 34 continue to recommend a “buy” recommendation on the stock, while only four suggest a “hold” rating for the stock. According to the consensus estimate for the price objective for the next 12 months, there is potential for an increase of 4%.