Feintool International: sells its capital goodss operations 2023

The CERTINA GROUP acquired Feintool International Holding AG and its US and Chinese subsidiaries on May 11, 2023. Feintool Holding and CERTINA will collaborate on hydrogen technology as part of this deal. Feintool Technologie AG will also maintain a 15% strategic minority stake.

Feintool Technologie AG, a capital goods company, offers cost-effective fineblanking and shaping system solutions as a full-range provider.

The company has mechanical engineering, customer service, and sales teams in Lyss (CH), Rapperswil-Jona (CH), Cincinnati (USA), and Shanghai (CN) and can provide quality press and tool systems to customers worldwide. Sales of CHF 29.3 million and a negative EBIT contributed 3% to Group sales in 2022.

We may focus on fineblanking, shaping, and electrolamination stamping after selling the capital goods company. This comprises cutting-edge tooling across the industrial chain and novel electric motor product solutions. Torsten Greiner, Feintool Group CEO, said the capital goods business will benefit from the new owner’s industry relationships and sustainable investment experience.

Guidance changed

Certina welcomes Feintool Technology AG and the team as trusted partners. Dr. Stefan Brungs, CERTINA GROUP Managing Partner, believes this deal will foster long-term growth for both parties.

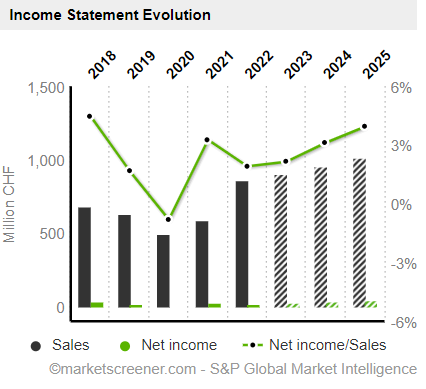

Feintool expects 2023 sales of roughly CHF 850 million after selling the press business. Feintool estimates a full-year EBITDA margin of roughly 10%, or 3% EBIT. The delayed pass-through of future technology input and ramp-up expenditures could boost the second half of 2023.

Certina Group

CERTINA is a family-owned industrial holding firm that helps European SMEs with carve-outs, turnarounds, and unsettled successions. Over 65 successful purchases in diverse sectors span 25 years of investment expertise.

The CERTINA GROUP has 21 firm platforms in five industries, with 3,600 people, and sales of approximately EUR 850m. Sustainability, continuity, and entrepreneurial responsibility have guided our investments from creation.

Operational investment opens sustainable prospects for organizations facing big changes in the benefit of all stakeholders. Our experienced managers and specialists often assist with difficult transactions and major business transformations, such as transforming integrated enterprises into SMEs.

Our robust and independent financial basis lets us independently re-align and sustainably expand our company without time limitations. Our capital and ownership structure offer flexible, pragmatic, and secure transactions to all stakeholders.

Internationally recognized corporations have trusted CERTINA as a transaction partner and “good-home” for their non-core activities for over 20 years.