Deloitte leader: Businesses must change business models for growth 2023

The Singapore economy is anticipated to slow this year.

Jiak See Ng leads Deloitte Asia Pacific’s Financial advising practice, developing and leading the company in M&A, economics and commercial advising, infrastructure, forensics, investments, and restructuring.

She has advised clients across sectors on M&A, financing, IPO, and growth strategy for 30 years.

Ng supports Asia Pacific female Deloitte professionals in the Women in the Leadership program.

Ng said that current trends in sustainability, ESG, responsible investment, and social impact create possibilities for organizations as Singapore’s economic development slows this year.

She said firms will restructure, refinance, and recycle cash to be competitive and flourish in unpredictable times.

She noted that organizations must be ready to adjust their business strategies to grasp opportunities and ensure sustained growth in such scenarios.

Ng spoke with SBR about the city-state’s business landscape, ESG, and sustainability, and how young professionals can succeed in financial advisory.

Which business issues did Singapore experience last year? How can corporate leaders handle them this year?

Rising interest rates, geopolitical uncertainty, Russia-Ukraine, and COVID-19 recovery make today’s business climate risky. These variables have caused supply chain disruptions, customer behavior changes, fast digitalization, and workplace changes.

Industry leaders and corporate personalities may address these issues in numerous ways.

Upgrading technology and infrastructure, training employees, and creating new digital products and services can help businesses stay competitive and adapt to changing customer behavior.

Businesses should adapt their talent strategy to accommodate remote workers as demand rises. To hire and retain top people in current talent war and changing work environment.

Diversify company models to avoid supply chain difficulties.

Collaboration matters. Collaboration with the public sector and other enterprises, especially in the same ecosystem, may offer new possibilities and provide value for customers.

What should firms adjust in their business strategies to remain ahead of the projected economic slump this year?

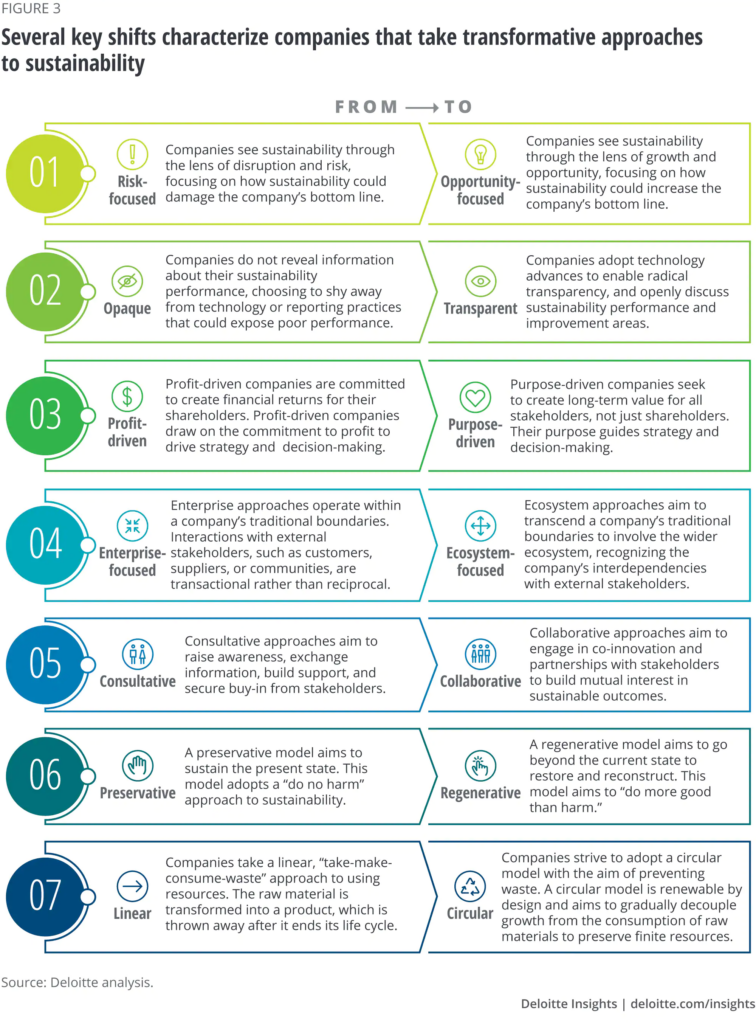

Companies must change their business strategies to capitalize on economic slowdowns and develop sustainably.

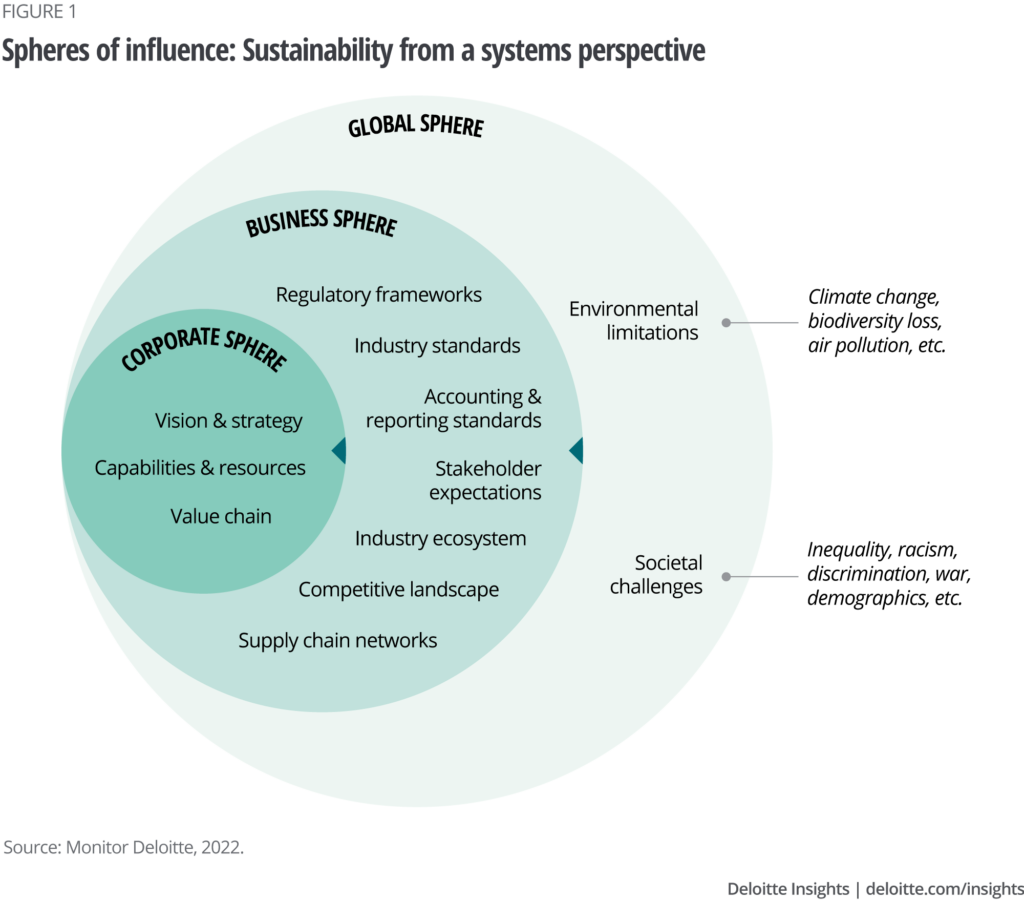

Sustainability, ESG, responsible investing, and social impact developments provide opportunity.

To stay competitive and develop in these unpredictable times, firms will likely restructure, refinance, and recycle their money.

In this environment of rising interest rates, companies must manage their working capital, liquidity, deployed capital, balance sheet, and supply chain.

Businesses must prepare for increased regulatory scrutiny and stakeholder expectations of ESG responsibility.

How can Singaporean companies market ESG and sustainability programs to stakeholders as more industries adopt them? How can they continue?

Transparency is essential. Transparency with stakeholders—employees, customers, investors, and the public—helps promote sustainability activities. This can include progress reports, best practices, and success stories. Companies might also discuss sustainability failures. Honesty about challenges and solutions may create stakeholder trust.

A sustainability officer or team might help organizations integrate sustainability into all elements of their business.

Engaged stakeholders support ESG and sustainability activities. Forums, workshops, and social media can facilitate discourse.

Sustainability and quantifiable goals show long-term sustainability and accountability to stakeholders.

Companies should consider sustainability reporting. This would standardize stakeholder ESG disclosure, improving openness, accountability, and industry comparison. Global regulators increasingly require ESG and sustainability disclosures in corporate governance reporting.

What are your main performance metrics for business development and success this year? What obstacles do you anticipate in achieving these metrics?

KPIs are old. Revenue growth, client acquisition and retention, market share, employee happiness, and ESG performance are among them.

Economic uncertainty, supply chain interruptions, changing customer behavior, and workplace changes may hinder firms from meeting these KPIs. There is no common ESG reporting structure, and stakeholders may have different expectations, making ESG performance measurement difficult.

What advise would you give prospective financial advisors? What talents are necessary for success?

Today’s industry, laws, and client expectations require adaptability and a desire to learn.

Professionals must be skilled listeners and communicators in addition to having technical and subject-matter expertise to be attentive to customers’ demands and give solutions that fit their conditions. Build trust with clients and coworkers.

Predicting customer demands can help you give better recommendations. Because clients trust people they know and like, building these relationships is crucial. Trust also improves teamwork and morale. Success requires trusting clients and teammates.

From last year’s awards program, what innovations or crucial aspects are you seeking for this year?

I will search for firms with future-focused business models and plans. This comprises companies that use cutting-edge technology or sustainable methods to improve operations. I also like firms who have effectively adapted to market changes. I’ll also be looking for entries that show a dedication to great customer, employee, and stakeholder connections.